As noted earlier, in May 1989 I took part in a debate with the Federal Trade Commission (FTC) on the merits of their plan to require licensing of professional coin dealers. This debate was held at the Metropolitan New York Convention. Each side presented its case. Barry Cutler, the Director of the Federal Exchange Commission (FTC) led off the discussions stating that U.S. coins were being counterfeited and sold as authentic and that there were Investment Funds that sold gold to clients at a low premium, stored them "free of charge," but did not ever deliver them to the buyer. There were all kinds of scams, including instructing people to not open coin rolls or mint-sealed boxes or bags, as that would reduce the value. In this way customers could be ripped off by the inclusion of fake or low-grade coins that were only discovered if the roll or bag was opened. These were all concerns of the FTC, the Treasury Department/Secret Service, and the Security and Exchange Commission (SEC). From 1985 through 1989 the FTC apprehended some of these scam artists, arrested them, brought them to trial and fined them huge sums.

It was these offenses, along with misleading public advertising and various promotions that caused the FTC to seek a licensing requirement for all who bought and sold gold, treating coin dealers the same as they would proprietors of a pawn or hock shop. The FTC’s Barry Cutler wanted to have this forum or debate to hear from the Professional Numismatists Guild, Luis Vigdor, and myself about how to start the procedure and what the possible damage was for a "basically good industry."

Luis Vigdor, who was a senior officer of Manfra, Tordella and Brooks (MTB), reviewed in detail the buying and selling of gold coins by his and most established companies. He confirmed that their staff could readily recognize the counterfeits and often shared their findings with the Secret Service. MTB also ran a daily "buy and sell" operation, as gold, like other precious metals had to be treated like other commodities, where the buy price is a small fraction below the sell price.

If a small coin dealer, a Mom and Pop operation, or a small local jeweler was treated like a pawn shop, they would have to verify the seller’s identity, report the "buy" to the local authorities (as is required by a second-hand dealer’s license in most cities and state) and would have to hold the coins for 30 days. Those who did not have enough capital could not afford to hold these items that long and could lose what they had invested. Since coins do not have a serial number or other special I.D., identifying stolen property would be virtually impossible. The suggested regulations could very well close many small coin shops, and have a detrimental effect, even on large coin dealerships. After Luis Vigdor’s explanation about the running of a precious metal and rare coin business he turned the floor over to me.

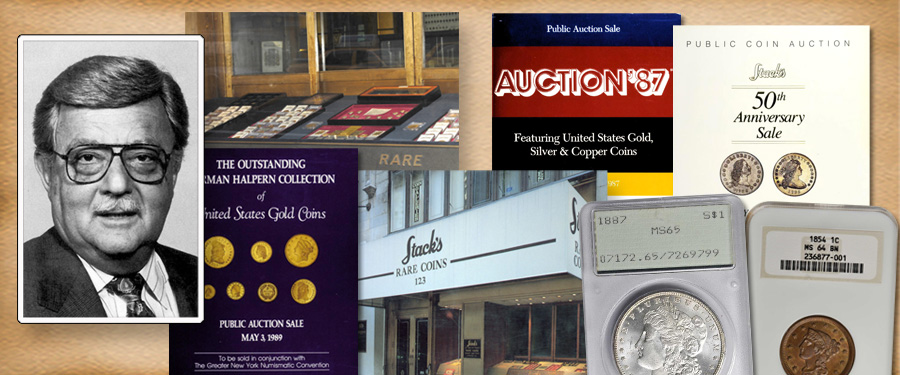

As president of the PNG, I was able to discuss the operation of the rare coin business. I started by explaining that most professional dealers have seen, bought and sold enough gold coins that they were readily able to recognize false or counterfeit pieces readily. The larger retail dealers across the country bought all types of coins, sold many over the counter or at public auction, and respected their clients. Their Code of Ethics required them to compensate anyone to whom they had sold a false coins. The PNG (the largest dealer organization in the United States), together with the International Association of Professional Numismatists (IAPN) provided guidance to rare coin professionals on such matters. As part of this debate, my role was to help the FTC understand that most professional coin dealers were not the problem, and that setting up a licensing system would not effectively address the situation.