?While Harvey Stack passed away on January 3 of this year, we are pleased to continue to offer readers the articles he had already written, so that they can be read and enjoyed as he would have wished.

The year 1994 continued the upward trend in numismatics that had begun with the recovery from the Black Monday stock market "crash" of November 1987. This recovery was helped by the fact that the precious metals markets held their value, so coins that contained gold and silver may have lost a little value, but in general were considered a "good hold." During times when the stock market was way down, coins made of precious metals were considered by many to be a store of value and a better source for investment.

In addition, collectors who had the means used this time as an opportunity to add to their collections while prices were down slightly, and so continued to be good clients both through our auctions and in our retail sales. Many important collections were created and developed during this period. Buying and selling of coins among dealers also became a good business.

One ongoing issue was the large-scale production and sale of commemorative and other coins by the Mint, specifically geared toward collectors and investors, and marketed as an "investment in the future." Over its history, the Mint had always produced a certain number of coins specifically for collectors, most notably Proof coins and Proof sets and commemorative coins of the classic series from 1892 through the mid 20th century. In general, these collectible programs were good for the hobby, appealing to a certain type of collector and attracting new people to numismatics. They also tended to be sold at prices that were not much over the face value of the pieces, at least by the Mint.

In addition, certain "regular issue" coins also provided this outcome, whether intentional or not. I have seen it written that the change to the Barber coin design in 1892 for the dime, quarter and half dollar was a way to attract attention from the public. The Liberty Seated design had been in circulation for more than half a century and there was very little interest from those who collected from change. The coins with their new "look" were saved as a novelty and many ended up in piggy banks, kitchen jars, and dresser drawers. Of course, any new design made the coins that had been made before more interesting, as they were seen less and less in commerce.

A well-known example of a new coin issue leading to increased collector interest happened in 1883 when the Liberty Head nickel was first issued, a change from the Shield design which had been minted since 1866. The initial design for the 1883 nickel had just the letter "V" on the back to state the denomination, with no reference to what that "5" stood for. Millions of these nickels were made and released into circulation. Some of these were expertly plated with gold and passed off as $5 half eagle coins to unsuspecting businesses and the public. The Mint tried to withdraw all from circulation, but they were mostly unsuccessful. They then added the word CENTS under the V on the reverse and issued another 16 million coins. Although there were millions of the "CENT-less" nickels out there, the public thought that they would be rare and valuable. That did not end up being the case, but this turn of events led many to join the ranks of coin collectors.

In general, new designs nearly always stimulated increased interest, whether it was the advent of the Morgan dollar, the new designs of the early 20th century (including the fabulous new gold $10 and $20 designs by Augustus Saint-Gaudens), and even the Bicentennial designs of 1976 and the state quarters released beginning in 1999 (much more about this in a later article). As a rule, this was always a positive thing for numismatics.

However, by 1994 the Mint was creating more and more "non-circulating" coins for sale specifically to collectors and investors — larger numbers of designs and denominations and larger mintages. Even with attracting new purchasers using extensive marketing campaigns, there was not enough interest to maintain prices for so many items and the constant striking and offering of new designs, special issues, special sets, bullion related medals and tokens to be sold at large premiums flooded the market. Those who bought these "investments in the future," especially if they were not long time collectors, were often disappointed when they went to cash in on their investment. As noted earlier, we at Stack’s often had people come in the shop or contact us to sell or appraise these items and had to be the bearer of bad news about how the current value was lower, not only of what they had expected, but often lower than what they had paid. It was evident to us that the Mint’s pricing and selling practices were excessive and were having a negative effect on the hobby and discouraging people from collecting.

It seemed to me that the Mint was not concerned with the buyers of their products or if those buyers lost money and also was not concerned about the growth of coin collecting as a hobby. It has always been my hope that in the future the Mint will start to make interesting coins for general circulation by commemorating important historical facts and get them out to the Federal Reserve Banks for general "change distribution." In this way the public could learn a bit of history from the different coins and appreciate each coin as an important part of economic life. All could realize that the Mint’s job is to provide a medium of exchange to bolster and maintain our daily economy and be less concerned with how much profit can be made when the products are sold.

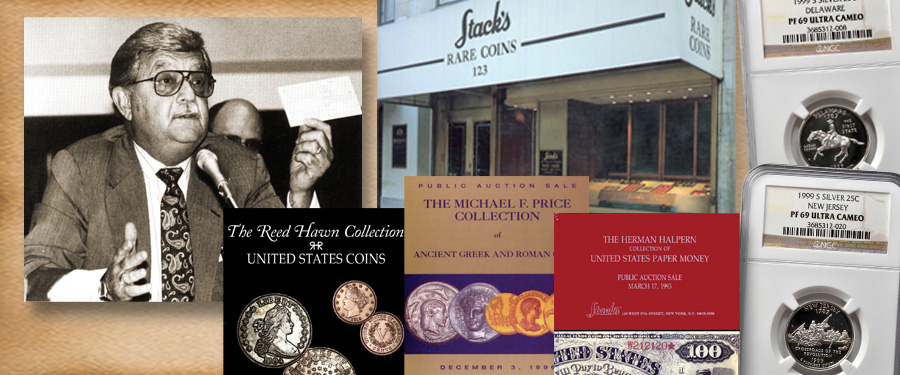

Meanwhile at Stack’s we continued to use our decades of experience working with collectors of all levels to appraise, buy and sell the numismatic items that came our way. Whether it was a large, curated collection, a specialized hoard of items, or coins that ended up in a cookie jar or dresser drawer, we did our best to stimulate the hobby and provide a positive experience for everyone. Our role was to provide service to those entering the hobby, to those in the process of building collections small and large, and to those who were ready to sell, whether a part of their holdings or the entire cabinet. We also adapted to changing times as many of the people we served became more dependent on grading services and use of the Internet. These factors brought growth to numismatics and we saw more and more visitors to the shop, increased participation in our auctions, and greater attendance at conventions and coin shows. It was a very exciting time, and resulted in a strong year of auction presentations, which I will discuss in my next article.