In the 1970s and 1980s I used to teach the “All About Coins” class at the American Numismatic Association Summer Seminars in Colorado Springs. This was always an enjoyable experience and the class was always well attended. Some of my teenaged students went on to become highly successful rare coin dealers—Dwight N. Manley, Dan Ratner, and Kerry Wetterstrom being examples.

On July 15, 1980, I was interviewed by Jim Lyons, who was at the Summer Seminar, and who later published this in Coinwatch, his monthly market report. This excerpt seems to be as relevant today as it was 36 years ago! Here goes:

“Coinwatch: Dave, what has taken place the fast few months in the coin market?

“Bowers: Certain prices have dropped—have adjusted—that went up fast earlier in the year. Other coins have increased in value, such as scarce colonials and the like, so it’s been a rather mixed market.

“Coinwatch: You issued several warnings of an impending market crash in 1964, and you were right. What do you think is coming in the U.S. market?

“Bowers: There have been three crashes that I have correctly predicted so far, but when the market crashes, only part of the market crashes. For example, when Proof sets crashed in 1957, type coins were as good as ever, large copper cents were as good as ever.

“In 1964 when the roll, bag, and Proof set market crashed, early coins that were basically rare were as strong as ever and kept going up in price.

“In 1975 and 1976 when gold coins crashed, type coins were as strong as ever…

“Coinwatch: Where do you see most investors making mistakes?

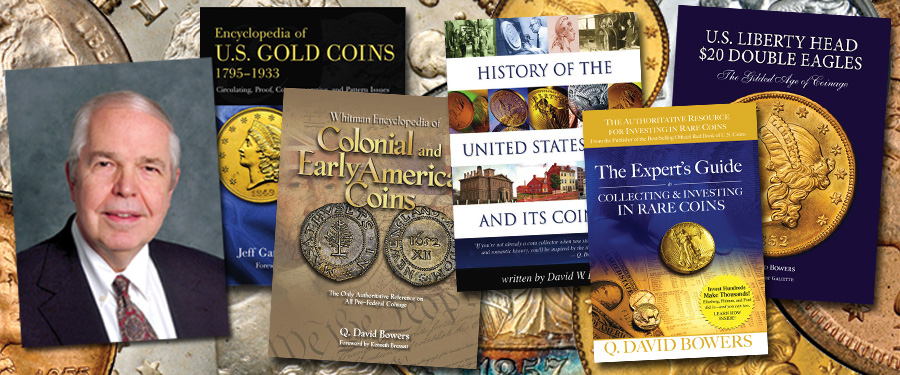

“Bowers: By not building a numismatic library, by not joining the American Numismatic Association, by not coming to a Summer Seminar such as this—not reading, but instead just throwing their money at the nearest coin seller.

“Coinwatch: Blindly so to speak.

“Bowers: Right…”

Starting in the 1990s I was a guest lecturer at Harvard University. The title for each of the 18 years I did this was “Collections and Curation: Collecting in the Marketplace.” My audience was composed of graduate and other students who hoped to go into historical research, museum curatorship, and related fields. As part of my program I discussed market cycles and fads in many categories—from fine art to coins to stamps to autographs. All such categories that attract moneyed buyers who seek to make extensive purchases have gone through similar cycles!

I do not pretend to predict cycles for modern art or autographs or restorable Victorian houses, but I have had a lifetime of experience with rare coins. As has been said, the more things change, the more they are the same.

For you to be a successful buyer of rare coins will require some work on your part. Reading books does take some time. But, among other things I believe you will gain an appreciation for coin market cycles and will be able to see them as they occur. Building a basic working library of useful books is essential and will cost several hundred dollars for starters. The passage of time is needed to gain experience. The reward may well be the addition of a new element of challenge and enjoyment to your life, the making of many new friends, and the reward of investment success.

What could be more ideal?