Welcome to the first of my series of weekly comments on highlights from the Joel Anderson Collection of federal paper money. The first narratives will feature notes that will be sold by Stack’s Bowers Galleries at the Whitman Coin & Collectibles Expo, March 21-23, 2018, at the Baltimore Convention Center. We’ll have the red carpet out for you if you plan to attend in person. Otherwise you can bid in virtual reality on the Internet, a “you are there” experience. Our catalog will give complete information.

Joel Anderson’s interest in numismatics dates back many years. As a young man in 1963, he and his brother Charles were on hand at the Treasury Department in Washington when long-stored silver dollars were released in quantity. In later years, Joel has formed several specialized collections. Connoisseurship has been the rule, combined with patience and careful expenditures to seek value.

Now in 2018, his collection of federal paper money by design types, including Treasury Seal and other major variations, is being presented to a new generation of bidders. I cannot resist stating that the Joel R. Anderson Collection of paper money is equivalent in its own way to the D. Brent Pogue Collection United States coins that we showcased from 2015 through 2017.

The Anderson notes by types include by definition many popular and affordable designs, especially among later issues. Rarities also abound, including many notes that are the finest in private hands or are unique. Although the rosters of great paper money collections, such as that of Albert A. Grinnell (sold at auction in the 1940s) and that of Amon Carter, Jr., sold privately through us a few decades ago, were larger in terms of signature combinations, the Anderson Collection takes the honors for being the most complete by types and having the highest overall condition.

I start this weekly series with an 1861 $20 Demand Note, Friedberg-11, as described in Paper Money of the United States, and Whitman-1907, as described in the Whitman Encyclopedia of United States Paper Money.

In my column, as well as in the sale catalogs themselves, each note will be described as to variety, rarity, grade, and, as available, pedigree or provenance. After that I will give historical and numismatic details that add information and interest.

I start not with a rarest of the rare note, but with a famous classic that will see strong competition and which is likely to sell in the high five-figure range.

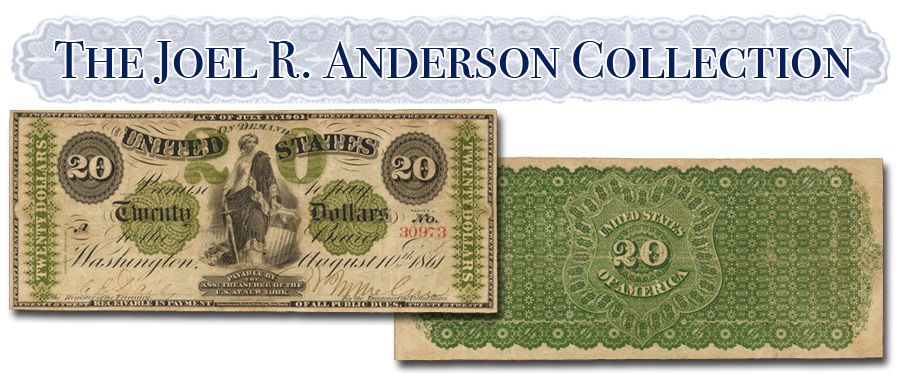

1861 $20 Demand Note, New York Friedberg 11, Whitman-1907

Only eight examples of this classic have been recorded in the census. Most are in the Very Good to Fine range. The Anderson note is certified as VF-25 and is likely exceeded by only a single note, an Extremely Fine example that has been off the market for more than a quarter century (otherwise it would probably be in this collection!).

The offered note is a solid Very Fine, perhaps conservatively graded. It displays only moderate evidence of circulation and has excellent eye appeal. The printed details are boldly inked, and there is sharp detail on the vignette of Liberty with sword and shield at center. The green color tints display strong color while the issuing signatures of the Treasury officials are neatly penned. Incredible detail is seen in the ornately printed green back design. There is minor edge restoration at the top margin, not affecting the printed areas of the note. I rate the eye appeal as superb.

Considering the other varieties of the 1861 $20 Demand Note, there are only 12 others recorded in the census.

Overview and History

From 1782 through 1860s, currency in circulation in quantity was limited to that issued by several thousand state-chartered banks plus the first and second Bank of the United States. The last two were chartered by Congress, but with most shares owned by private interests.

The production of standard issues of federal paper money began in 1861 as a measure to help finance the Civil War. The conflict began with the bombardment of Fort Sumter in the second week of April. It was thought by the North (or Union), that the contest would be short lived. The North was viewed as having great industrial strength, while the seven Southern states comprising the Confederate States of America were agriculturally based. President Abraham Lincoln called for three-month enlistments by soldiers — surely enough time to end the uprising.

That did not happen. It was not until late July that the first major battle took place at Bull Run in Antietam, Virginia, not far from the capital in Washington. The coming contest was publicized in the newspapers as the armies advanced toward each other. At the outset the Union troops took the advantage, but soon the Confederates took charge. The federal soldiers retreated in confusion and disarray.

It became clear that the war was going to last far longer than anyone thought. The Union Treasury, challenged for funds, issued Interest-Bearing Notes (well represented in the Anderson Collection) and Demand Notes, as here. The first were issued in anticipation of difficult times to come, under the Act of March 2, 1861. These paid 6% interest and sold quickly.

This was followed by the Act of July 17, 1861, amended on August 5, which authorized a new $250 million loan, comprising mostly Interest-Bearing Notes and bonds, but also including $50 million in currency to be known as Demand Notes. In contrast to Interest-Bearing Notes, Demand Notes were made in lower denominations for widespread popular distribution. As these bore no interest they were in effect a free loan to the government. The $5, $10, and, as here, $20 values gave them wide appeal.

Plates were engraved and notes were printed by the American Bank Note Company in New York City under a contract signed on July 25, 1861. The Act of August 5, 1861, added details, including convertibility, if desired by the holder, of the Demand Notes into long-term bonds paying 6% annual interest.

The first Demand Notes were paid out in August 1861 and used to pay government salaries in Washington. Soon thereafter, notes were given to Union soldiers, defense contractors, and others to whom the government was obligated. This form of payment was not welcomed by the recipients, who preferred “hard money” in the form of coins.

In different parts of the country many banks, merchants, and others refused to receive them at all at first. The situation was ameliorated when the Treasury Department sent letters to the various federal depositories authorizing them to pay out gold coins at face value on demand. This soon established public confidence, and Demand Notes were received everywhere. Given a choice, citizens preferred to them to the state bank bills that continued to be issued into 1865, and circulated alongside federal currency.

Demand notes were not paid out by the Treasury after December 28, 1861, as the supply of gold had reached alarmingly low levels. By then, $33,460,000 in Demand Notes had been paid out. This issue was supplemented on February 12, 1862, by an additional $10 million in Demand Notes redeemable in gold. By early March the entire authorized $60 million had been printed and issued. The price of gold coins rose in the marketplace, and notes of state chartered banks traded at discounts in proportion. In March 1862 Legal Tender Notes were authorized in large quantity, in values from $1 to $1000. These were exchangeable at par only for other paper bills. The era of gold coins in circulation had ended, and would not return until 1878.

Details of Demand Notes

The Demand Notes were payable in gold at five different federal depositories, known as Sub-Treasuries, located in New York City, Philadelphia, Boston, Cincinnati, and St. Louis. The New York office, under the authority of Assistant Treasurer John J. Cisco, was by far the most important. The life of Cisco, who became wealthy (the city of Cisco, Texas bears his name), is a fascinating story in its own right.

The backs of Demand Notes were printed in green ink, quickly giving rise to the term greenback, although this was more widely applied to the later Legal Tender Notes, which were issued in far greater quantities. Today in popular parlance, green is the “color of money.” The Demand Notes do not bear the Treasury seal as there was no requirement for this in the amended legislation of August 5, 1861.

The earliest bills were personally signed in ink by L(ucius) E. Chittenden, Register of the Treasury, and F(rancis) E(lias) Spinner, Treasurer. None of these are known to numismatists today. Soon a corps of 70 clerks was on hand to add their own names and the notation “for the” Treasury officers. Later issues, constituting the majority, had “for the” printed by the plate, but still were signed by clerks. As no recipients of the bills had any idea who these people were or what their signatures should look like, they had no security value. Demand Notes were issued from August 26, 1861 to March 5, 1862.

After the Legal Tender Notes were circulated, the Treasury Department began retiring as many Demand Notes as it could. Within a year after they were issued, Demand Notes, still exchangeable at par for gold, were seldom seen in financial circles, and none were in general circulation, as they were worth more than the Legal Tenders. By early August 1862, it took $115.25 in Legal Tender bills to buy $100 in gold coins or Demand Notes. By July 1, 1880, all but $60,535 of the Demand Notes had been redeemed.

Today, Demand Notes are highly prized by numismatists. Most show extensive wear. The Anderson Collection example is a remarkable exception.